- CultureBanx

- Posts

- CBX Daily 4/30/2025

CBX Daily 4/30/2025

Today, tech is guarded by encryption, but let’s start with how VCs overlooked Canva leading to its distinction…

In Partnership With

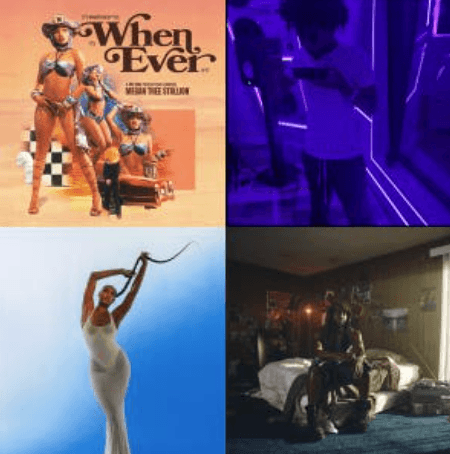

| Now Playing: |

Cultural Intelligence Download

Canva Was Ignored By 100 VCs & Is Now Valued At $40 Billion

Melanie Perkins didn’t look like a typical tech founder. She was young, non-technical, and based in Australia. That was enough for more than 100 investors to pass on Canva. Now, Canva is one of the most valuable startups in the world. The graphic design platform serves 230 million users and pulls in $3 billion in revenue. Perkins is the only woman to have founded a unicorn at this scale. And she did it while being overlooked.

Cloud Security Innovation Spurs Tech Leaders Towards New Solutions

CBX Vibe: | Businesses have huge databases and are increasingly looking for on-demand storage. With time, they will need to scale and that's where cloud computing comes in. And while cloud computing has all the benefits from easy access to scalability, it is imperative that sensitive information is protected against breaches, unauthorized access, and data loss which cost businesses $4.88 million. Microsoft's (MSFT +2.06%) BPGI partners–IntelligIS CEO Marcus Wilson, BizTech Fusion CEO Xadean Ahmasi and ECF Data CEO Joseph Henderson ensure that organizations are not just connected but are also protected and prepared. |

Golden Years Turned Grim: The Retirement Reality For Women

CBX Vibe: | For many women, retirement is no longer a reward; it’s a reckoning! As the retirement landscape continues to shift, a growing crisis is emerging—one that disproportionately affects women. Despite decades of participation in the workforce, women are retiring with just 70% of the savings their male counterparts. Consequently, women are 80% more likely to live in poverty during retirement. The harsh reality is that the golden years have turned grim – what should be a time of rest and comfort has become a struggle for financial survival. |

Tune-in Tuesdays!

China is hitting the U.S. by selling Mortgage-Backed-Securities (MBS) in favor of Bitcoin and gold to be on the safer side. This could spook the mortgage rates in the U.S. and reduce affordability. Is this a bold step toward de-dollarization or a gamble that could backfire in a volatile crypto market?

A. “The Breakup" by mgk – China’s pivot to Bitcoin and gold feels like a calculated breakup with the dollar, chasing independence and value in hard assets instead of IOUs

B. "Mo Money Mo Problems" by The Notorious B.I.G. – With great reserves come great responsibilities, and dumping Treasuries might just trade one kind of risk for another in the global power game which China is not afraid of

C. "All of the Lights" by Rihanna & Kanye West – Flashy as Bitcoin and gold may be, they come with chaos and volatility so China better be testing the waters or have a backup plan

What are your thoughts on this? Tune in next Tuesday to see which jam captures the prevailing sentiment! |

Last week’s results are in and it seems ‘Errybody’ can get it so no exceptions on tariffs for poor nations

How HBCUs Are Empowering Black Graduates Financially

CBX Vibe: | Historically Black Colleges and Universities (HBCUs) are more than educational institutions; they're catalysts for empowerment, shaping futures that gleam with promise. HBCUs with the highest payoff in 2024 are leading the charge, with Hampton University, Spelman College and Xavier University of Louisiana. Embracing an HBCU education in 2024 means embracing an opportunity to amplify Black graduates careers and income prospects. |

What America Needs To Know About Tariffs & Economic Uncertainty

CBX Vibe: | Tariffs aren't just a headline in the news—they are directly impacting our wallets, communities, and futures. As the U.S. embraces protectionist policies, the economic ripple effect touches every corner of our lives, from the cost of daily necessities to job security. The Biden administration's recent flirtation with increased tariffs has economists shaking their heads. Tariffs could knock at least 0.8% off U.S. GDP growth. That's more than just economic jargon—it translates into fewer job opportunities, higher costs, and a weakened position in the global marketplace. America's competitive edge isn't just about prestige—it's about stability for families trying to thrive. |

Vibes of the Week

VCs ignored Canva, but it’s now enjoying “Money On Money” as Young Thug and Future tell it in our CBX Vibes! |